FREQUENTLY ASKED QUESTIONS

The purpose of the page is to educate you on how different types of mortgages work and how to use them to your advantage. You will find all the information that you may be looking for here, written in easy to understand terminology. Should you have any other questions, feel free to call me by telephone at (510) 325-8800, or by Email at richard@caliref.com.

Why Use A Mortgage Broker?

A good mortgage broker, that you trust, can save you money. He knows who has the best interest rates and the best programs. He knows where your loan will fit. He knows how to package your loan so that it is approved quickly and easily. A good broker knows that if they make you happy you will refer your friends and family. And that is what all-good mortgage brokers want-A mutually beneficial relationship with you!

No one, not even the best mortgage broker, has the best interest rate all the time. There are just too many companies out there for anyone to always have the best interest rate. With a good broker you can rest assured that you will get very close. Good brokers also tend to deal with lenders that make things easy on the borrower (you). Less hassle makes clients and brokers happy.

When Should I Lock-In My Interest Rate?

This is where a great mortgage broker comes in handy. Locking your interest rate is free at almost all companies. Locking your interest rate is when you and the lender agree upon which interest rate, program and fee you will choose on a specific date and for a specific period of time (usually 15, 30, 45 or 60 days). You must close your transaction within the time frame selected. If locking in your interest rate, is free then why not lock it in? If you went to a direct lender (like your local bank) and lock in your interest rate and interest rates fall you will usually be stuck with that interest rate. Lenders do not renegotiate interest rates once you lock in. They don’t even renegotiate with mortgage brokers. Their attitude is that if you locked your interest rate with them and interest rates go up they wouldn’t ask you to take a higher interest rate, and you wouldn’t. You would want them to stick to the agreed upon interest rate. Some lenders say they will let you renegotiate your rate once if rates fall, but they will not give you the prevailing interest rate. Instead, they will meet you somewhere in the middle between the interest rate they locked and the prevailing interest rate on the day you want to renegotiate. With a good mortgage broker you can simply re-lock your interest rate with another lender. The broker owns your loan until the lender funds the transaction. Since the broker owns the loan and all of the documentation in the file he can simply take the package and give it to another lender to get you a better interest rate. If you went with your local bank they would own your package and would not let you give it to another lender or bank. You would have to start all over again with the new bank. New loan application, new credit report, new appraisal, new copies of your financial documents and a new escrow.

What Kind Of Loan Program Is The Best When Purchasing A Home?

There is no absolute rule when buying a home as to what loan program works best. It depends on the current market. The only advice I have and stand by is to take a loan with the lowest possible fees. I say this for one important reason. When you enter a contract to buy a home you will have a clearly defined timeframe in which you must close the deal. During that time frame interest rates are what they are and you cannot wait for them to fall. You must close on that date or you may lose the home you want to buy. Realize this, the only thing permanent about buying a home is the price you pay for it. You can and should look to improve the loan you have at all times. In other words, you should look to refinance when you are not in a hurry to do so. That way you can watch the market and refinance when you think the time is right. I should point out that it is very difficult to get a no-cost loan on a purchase, but not impossible. You should always ask if a no-cost loan is available for the purchase you are making.

When Are Home Prices The Best?

Prices on homes are always better when interest rates are high. The loan you obtain is always refinance-able (my new word this month). In other words, I bought my house when rates were high. Because they were high I got the home at a very attractive price. I chose a one year adjustable rate mortgage, with no prepayment penalty and no points, and refinanced to a fixed rate when interest rates improved. Prices in the country are directly related to monthly payments. Most people buy based on the payment. If the payment fits into their budget they buy. If it doesn’t they don’t. These new loan programs have pushed payments down, an illusion, and lead people to believe they can afford higher priced homes. This is one of the main reasons that home prices accelerated in recent years. If you believe, as I do, that the economy is not as strong as some believe then you can anticipate interest rates falling in the coming year or years. This could be a good time to start looking for a good deal.

Are There Good Tips For First Time Buyers?

The best tips I can give a first-time buyer is not to rush into buying a home with no money down. This is the biggest mistake most first-time buyers make. Prepare yourself by saving money. An easy way to do this is to try to save the amount of money each month by which you expect your monthly expenses to increase. For example, if you are paying $1,400.00 a month in rent and expect your home payment to be $3,000.00 a month, then you should be able to save $1,600.00 per month for one year–comfortably. At the end of the year you should have at least $19,200.00 in savings. If you can do this then you are ready to buy. The savings you have can be used to put money down or used to buy things you will need for the home (refrigerator, washing machine, dryer, lawn mower, etc.). It can also be used as a buffer to handle unexpected expenses and problems. Do not buy a home with no money in the bank. Home ownership and life are expensive. Have a cushion (savings).

Why Is A Down Payment And/Or Equity Important?

Perhaps a better question is why is buying a home with no money down not a good idea? When you purchase or own a home your equity is your savings account. Savings is important for unexpected expenses in our lives. The most obvious reason to not buy a home with no money down is that you can not even afford to sell the home if the need arises. It costs at least 6% (real estate commissions) of a home’s value just to sell the home. If you have no equity you can not solicit the help of a licensed real estate agent. If you think you can sell your home without the use of a real estate agent realize that the real estate community will not show your home to potential buyers for free. The seller is usually responsible for paying both the listing agent (the agent who puts your home on the market) and the selling agent (the agent representing the buyer). The 6% commission (commissions are negotiable) is usually split 50-50 between the two. So even if you do not use an agent you will still have to pay the selling agent if he/she brings you a buyer. If you have no equity you will have to pay them out of your own pocket. Good real estate agents are worth their weight in gold. A good real estate agent will get you top dollar for your home and save you money getting you the best price when you buy.

Things happen every day and it is important to be prepared for the unexpected. Having savings and or equity in your home helps you prepare for these events.

In today’s world your credit rating is becoming a very important part of your life. Employers are running credit checks prior to hiring. They think that people with good credit are more reliable and harder working. Losing a home in foreclosure can devastate your credit. Don’t jump into a home to soon. Remember to save for at least 12 months.

The older generation realized that the equity in a home was important. They used it to help with the cost of owning a home. Equity was used, as it should be today, to finance a new roof, a kitchen update, a bathroom renovation, to pay for a child’s college education, a nest egg for retirement, etc. Without equity a new roof may not be possible, let alone a child’s future education or your retirement. Build equity as fast as you can.

There are exceptions to every rule. I had a gentleman call me one day that was a perfect candidate for a no-money-down purchase. He had saved a substantial amount of money through his employer’s 401k savings plan and did not want to touch his retirement funds to buy a home. He understood the value of this investment but also understood the need to buy a home. This gentleman was perfectly balanced in his thoughts. Why withdraw tax-deferred savings that will continue to grow tax-deferred to buy a home when he could take advantage of a no-money-down loan and take advantage of the tax savings of home ownership. I can assure you that this man would build his equity position in the home while still maintaining the necessary contributions to his 401k plan. This is a mature outlook on his future.

What Are Closing Costs?

Closing costs vary from lender to lender, title company to title company, and mortgage broker to mortgage broker. What I will try to do here is explain in a general format the basic closing costs associated with a mortgage. Cost will be broken into two categories, non-recurring and recurring fees. Non-recurring fees are fees that only show up once when you get a loan. This explanation will break up the non-recurring fees as lender fees and title fees. In this way you can see who is charging what and what to look out for. After the loan closes you will not see these charges again until you apply for another loan. Recurring fees are fees that you pay monthly, but are actually charged to you daily, such as interest on the loan, property taxes, homeowner association fees, and homeowner insurance.

LENDER NON-RECURRING FEES

Loan Origination Fee: These are points that you pay to obtain a lower interest rate. 1 point is equal to 1% of the loan amount. On a mortgage of $300,000.00 at 1 point, you would pay $3,000.00. If this loan had 2 points you would pay $6,000.00.

Appraisal Fee: This a fee paid to a licensed real estate appraiser to determine the value of the property you own or are buying. It ranges between $350 and $600. It can be higher for a multi-unit or rental property.

Credit Report Fee: This is a fee paid to a credit-reporting agency to run your credit report. Lenders usually run credit through three sources such as Experian, Equifax and Transunion and prepare a consolidated credit report. It ranges from $18 to $50.

Lender Inspection Fee: If the lender has some question regarding the property that was not answered in the appraisal or other inspections that were done they may hire an independent inspection. This is rare but it does happen. It usually costs about a $100 to $300.00..

Tax Service Fee: This is a fee paid to a company to track your property tax payments. If you don’t pay your property taxes, the lender will be notified by this company.

Processing Fee: This is a fee charged by lender and/or broker for general handling of paperwork. It ranges from $595 and up. Watch out for this fee because it can be expensive from place to place.

Underwriting Fee: This is a basic junk fee charged by lenders and is sometimes called a documents fee, processing fee, underwriting fee, etc. Sometimes lenders use all of these but typically the fees add up to be about the same as quoted here. It usually ranges between $695 and $995.

Wire Fee: A charge to wire funds to escrow. It usually ranges between $40 and $100.

TITLE & ESCROW NON-RECURRING FEES

Escrow Fee: This is sometimes called a settlement fee or closing fee. It varies according to the purchase price of the home or the loan size on a refinance.

Title Insurance: This fee varies according to the purchase price of the home and/or the loan size.

Document Preparation Fee: This is an escrow fee to prepare documents. This fee can be questioned. Find out what they are preparing that the lender did not. If they are preparing nothing this fee should be nothing. It is usually around $100.

Notary Fee: This is a fee paid to a notary, escrow officer, to notarize your signature and verify identity. It usually ranges between $100 and $150 depending on the number of notarized documents.

Recording Fee: This is a fee charged by the county to record documents. It usually ranges between $50 and $150 depending on number of documents to be recorded into public records.

City & County Transfer Tax: This is a tax assessed by the county and sometimes the city on the transfer of title on real estate within the county or city jurisdiction. There are a few exceptions, though these fees do not exist on a refinancing because the property is not changing hands. The amount of the fee varies from county to county and from city to city. Sometimes it is paid by the seller. Call for a quote in your area.

RECURRING FEES

Interest: This is prepaid interest that you owe a lender at closing. It can be anywhere from 1 to 30 days of interest on the new loan. For further explanation go below to “What Is Prepaid Interest?” This topic is a little more involved than you might think.

Property Taxes: These are any taxes outstanding on the property that must be paid prior to the lender closing (funding) the new loan.

Homeowners Insurance: This is sometimes called hazard insurance, fire insurance, etc. Lenders typically require that you prepay anywhere from one to twelve months in advance depending on whether it is a purchase or refinance.

The distinction between recurring and non-recurring fees is an important one. On a purchase transaction the lender will only allow sellers to credit (pay for) the buyer’s non-recurring fees, not the recurring fees. On a no-cost loan the lender or broker will only be allowed to pay the borrower’s non-recurring fees not the recurring fees. Some lender do allow the broker to credit for both.

What Is Prepaid Interest?

Prepaid interest is interest that you pay in advance. Prepaid interest can only occur at the closing of a loan. It is a one-time thing. The following may help me illustrate this. When you rent an apartment you pay rent on the first day of the month for the month that you are going to live there (On Aug. 1 you pay rent to live in the apartment for the month of August). When you have a mortgage you pay the interest at the end of the month for the month that you have already lived in the home. It gets a little confusing because your monthly payment is due on the first of the month. What most people don’t realize is that they are paying the lender for the previous month’s interest (your Aug. 1 payment is applied to the interest owed for July). In other words, interest on a mortgage is paid in-the-rears. I could explain why but, that would take way to long and isn’t necessary for this explanation.

When you buy a home you will probably close escrow in the middle of the month. Let’s say on Aug. 15. Lenders follow a rule that says a lender cannot bill you your first payment unless it is greater than 10 days after the close. Since Sep. 1 is only 16 days away from the closing date of Aug. 15 they cannot bill your first payment until Oct. 1. When you make your payment Oct. 1 you are paying the lender the interest that you owe for September. But, and this is a big but, the lender gave you the loan on Aug. 15, and we all know that lenders don’t give anything for free. You still owe the lender interest for the last 16 days of August. So the lender will charge you at closing on Aug. 15 for those 16 days of interest in advance. This is prepaid interest. If you close early in the month this charge will be higher because of more remaining days in the month. If you close later in the month this amount will be smaller. If you close at the end of the month this number could be zero. Most buyer want to close near the end of the month.

How Does A 30 or 15 Year Fixed-Rate Mortgage Work?

A 30- or 15-year fixed-rate mortgage is the simplest and most straight forward loan available. Because they are straight forward, predictable and fit nicely within individual budgets, these loans are also the most popular mortgages. These loans are fully amortized, which means that a portion of your payment is applied to the principle balance of your loan and a portion is applied to the interest owed on the loan each month. At the end of the term (30 or 15 years) the loan is paid off. Very simple!

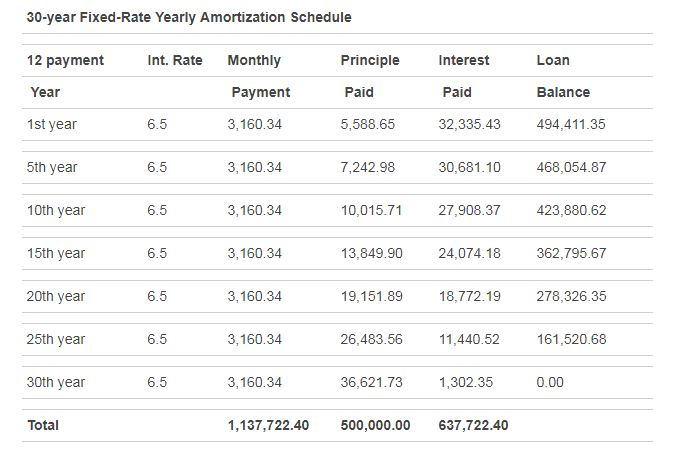

Let’s see how they work and how they compare to each other. In this example we will borrow $500,000. The interest rate on the 30-year fixed-rate loan is 6.500% and the interest rate on the 15-year mortgage is 6.125%. The rate difference between the 30-year and the 15-year rate with comparable fees (same points and miscellaneous fees) is usually between 0.250% and 0.500%. The 30-year interest rate is usually higher than the 15-year interest rate. In this example the rate difference we are using is 0.375% (6.500% minus 6.125% equals 0.375%).

| 30 Year | 15 Year | |

|---|---|---|

| Loan Amount | $500,000 | $500,000 |

| Interest Rate | 6.500% | 6.125% |

| Monthly Payment | $3160.34 | $4253.12 |

| Difference in Payment | $1092.78 | $1092.78 |

On the 30-year mortgage you will pay over the life of the loan $3,160.34 (monthly payment) X 360 (months) = $1,137,722.40. This represents $500,000.00 in principle and $637,722.40 in interest paid.

On the 15-year mortgage you will pay over the life of the loan $4,253.12 (monthly payment) X 180 (months) = $765,561.60. This represents $500,000.00 in principle and $265,561.60 in interest paid.

The 30-year loan helps borrowers buy bigger homes because of the smaller monthly payments required and offers more tax deductible interest. The 15-year mortgage restricts your buying power because of the higher monthly payment, and offers less tax deductible interest. However, the 15-year mortgage does help you pay off the loan faster. The decision you make has a great deal to do with your current financial situation and goals. More on that later.

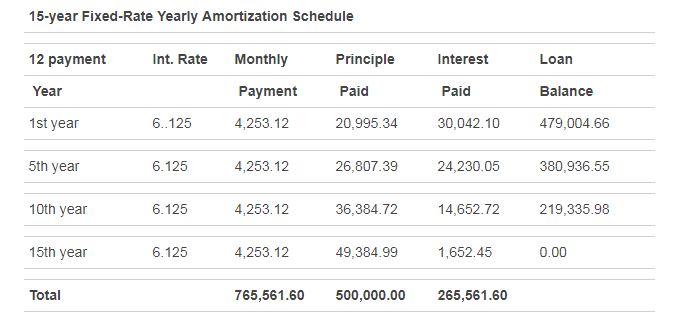

How The Payments Work (Amortization)?

Each month you send in your mortgage payment the lender divides your payment according to an amortization schedule. In the beginning of the repayment period, a small portion of your payment is applied to the balance of your mortgage. The other portion is applied to the interest you owe for that month. As you move to the end of the mortgage’s life more of your payment is applied to the balance and less is applied to interest. Let’s use the 30-year mortgage example from earlier to illustrate this. In the example, we will only show each fifth year:

The 15-year mortgage works the same way but, over a shorter time frame. In the example below we will show only every fifth year.

Is A 30-year or 15-year Loan Better for Me?

Most would argue, for many reasons, that a 30-year mortgage is a superior product. The lower payment can help you to borrow more money today and in the future. We have already indicated that with a smaller monthly payment you can borrow more today. But, what about in the future? Let’s say that a few years down the road you want to buy a new home but keep your existing home as a rental. With the smaller monthly payment, on the 30-year mortgage, your rental property will have better cash flow than with a 15-year mortgage. In the example above the 30-year payment was $1,092.78 less than the 15-year mortgage. So if your goal is to continue acquiring more property then you should look for the smaller monthly payment. The higher monthly payment associated with the 15-year mortgage can cut into your borrowing power.

Another powerful reason to take a 30-year mortgage over a 15-year mortgage is wealth accumulation. They say, as do I, that if you invest the difference between the monthly payment on a 15-year loan and the payment on a 30-year loan you would acquire more wealth. If interest rates work to your advantage you should have more money saved at the end of 15 years than you owe on your 30-year mortgage. Here’s an example:

After paying on your 30-year mortgage for 15 years your balance on the loan would be $362,795.67. If you invested $1,092.78 (the additional money each month you would have paid if you had chosen the 15-year mortgage) for 15 years at a rate of return of 8% you would have accumulated about $380,664.61. In this example you come out ahead by $17,868.94. Cash saved of $380,644.61 minus the balance of your mortgage $362,795.67 equals $17,848.94. We have not taken into account the effects of taxes in this example. At the end of 30 years you should have saved $1,639,492.56. Again we have not taken into account taxes.

This is where things start getting fun. I would like to take some time to explain the rule of 72.

What Is The Rule Of 72?

The Rule of 72 is simply the rule for doubling your money. Sound fun? It does to me! The rule is fairly accurate but, not perfect and does not account for taxes. Simply stated, if you take your anticipated rate of return on an investment and divide that number into the number 72 the result is how long it would take for your investment to double. Example: If you invest $10,000 and expect a rate of return (the interest you expect to earn on your money) of 10% you should expect to have $20,000 at the end of 7.2 years – 72 divided by 10.000% equals 7.2 years. If you invest $10,000 and expect a rate of return of 8% you should expect to have $20,000 at the end of 9 years – 72 divided by 8.000% equals 9 years. Now the fun begins.

In the mortgage example used above (30- vs. 15-year mortgage) we said that at the end of 15 years you should have $380,664.61 saved. If you continue to receive an 8% return you would have at the end of 9 more years $761,329.22 saved. The doubling or Rule of 72 only applies if you do not continue adding a monthly savings amount. You just simply let what you have saved grow. If you do continue to add to your savings on a monthly basis the effects of your savings would grow at a much faster rate. At this time you have paid on your 30-year mortgage for 24 years and your balance on that loan should be $188,004.24. The doubling of money continues from there. Over the next nine years you should have saved $1,522,658.44 with your mortgage having been paid off several years earlier. Remember the Rule of 72 does not account for continuous monthly savings amounts. This is a “let it ride” effect.

Well that’s the argument for a 30-year mortgage. We left out the tax effect and we have not compared that to the amount of money you could have saved by taking a 15-year loan. I just wanted to give you a little food for thought on saving money. The rule holds true. The younger you are when you start saving money, the more times in your life your money will double. So start saving today!

Well let’s look at the 15-year mortgage. After the 15-year mortgage is paid off completely you can start saving the whole 15-year mortgage payment of $4,253.12 each month for 15 years using the same rate of return (8%) we used to save money on the 30-year mortgage example. This will help us compare it to the 30-year mortgage. Remember we are just comparing this loan to a 30-year loan. At the end of 15 years you should have $1,481,553.69 saved. The 30-year mortgage still out performs the 15-year mortgage. At the end of 30 years you would be able to save $1,639,492.56 using the 30-year mortgage as opposed to saving only $1,481,553.69 on the 15-year mortgage. You come out ahead by $157,938.87.

This example helps you to understand the basic concepts of the Rule of 72. Saving less per month over a longer period of time yields a better result than saving large sums of money over a shorter period of time. The more time you give your money to double the more money you will have.

You can think of this in reverse as well. In the amortization tables above, we showed you that very little principle is reduced in the early years of a mortgage. So if you wanted to accelerate the payoff of the loan should you start paying extra (over paying) in the beginning of a loan or a few years later in the loan? The sooner you start paying extra the faster you will accelerate paying off the loan. An early extra payment will have the same but reversed compounding effects. The lender can only charge you interest based on the balance of the loan. If you cut the balance you cut the amount of interest they can charge. Since the loan has a fixed rate feature, the payment will remain the same throughout the life of the loan. Since it is a fixed payment a larger portion of that payment and every payment after that over payment will have to be applied to the principle balance. The sooner you start the sooner the loan will disappear.

What’s The Right Answer, 30-year or 15-Year Mortgage?

Well, there really is no right answer. The right answer depends on you and what type of person you are. I can preach to you about the value of saving money but some of us, most of us, don’t know how to save, don’t want to save or just plain can’t save. You have to know what type of person you are before you make any decision. An example of this is a very good friend of mine. He was very wise in the ways of money and could counsel anyone on what they should do and how to do it. He reminded me of the old saying that you don’t have to be a good player to be a good coach. He was a great coach. Not a great player. He just couldn’t save money. When he had a few extra dollars there was something he just had to have. Did he really need it? Maybe. Only he knows the answer to that. Regardless, he would buy it anyway. That was the way he liked to live and that’s what made him happy. Being happy is really what life is all about. He didn’t have a shortage of money and could definitely afford the higher payment on the 15-year mortgage. This individual new the right answer for him was the 15-year mortgage. He knew that if he wanted to pay off his home and not waste his money that the 15-year loan was better fit for him. He wasn’t going to miss the money if it wasn’t there but he new it would be spent on something if it was left in his account to spend.

When I was shopping for life insurance the same question arose. Should I buy whole-life or a term policy? So I did what I always do and started to ask older people I knew what they would do? They all told me the same thing. Get the term policy because it’s cheaper. Perhaps I should explain the difference between the two policies. A term policy is a life insurance policy that has a lower monthly premium (payment) than a whole-life policy. The term policy has the same death benefits (let’s say $600,000.00 worth of coverage in the event of death) as the whole-life policy. The whole-life policy has a higher monthly premium but has a cash value at the end. It works like a savings account as well as a life insurance policy. The term policy has no cash value at the end.

Well, the same issue of saving the difference between a 30-year mortgage payment and a 15-year payment arose. If I took the term policy and saved the difference of what I would have paid on the whole-life policy I would probably come out ahead in the game. And for all practical purposes that is true. But when I asked the same people if it would have been nice to have that extra savings in the bank, at this point in their lives, that the whole-life policy would have offered they all said the same thing: Yes, and they all said that they would have never missed the extra money they would have spent on that more expensive policy. None of them had taken the difference in the payment and put it away for a rainy day. What’s the right answer for you?

Some of these numbers are simplified to make it easier to understand and may be off by a small amount. No closing costs have been used in these examples. You should consult with a mortgage professional (Richard Pavao with California Real Estate Finance 510-325-8800) to obtain current interest rates, APR’s and fees. No APR’s (annual percentage rate) have been calculated as these are not real or current interest rates quoted. These examples are for educational purposes only. Each individual should consult with their own attorney and financial tax advisor before making any financial decision.

What Is A No Cost Loan?

A no-cost loan is simply a loan with no closing costs. I wish it were that simple. What does that really mean? Well it means that every company does it a little bit different. Some companies mean they add no miscellaneous charges of their own. Some companies mean there are no lender fees. And, then there are companies like California Real Estate Finance that have no fees at all. There are three exceptions, which no lenders will pay for you. They are interest on the loan, property taxes and your homeowner insurance or homeowner association fees. These fees are called recurring fees. The borrower must pay these fees, as they are ongoing throughout the life of the loan. Every day you own your home you will pay interest on the mortgage, property taxes and your homeowner insurance.

Is A No Cost Loan A Good Deal?

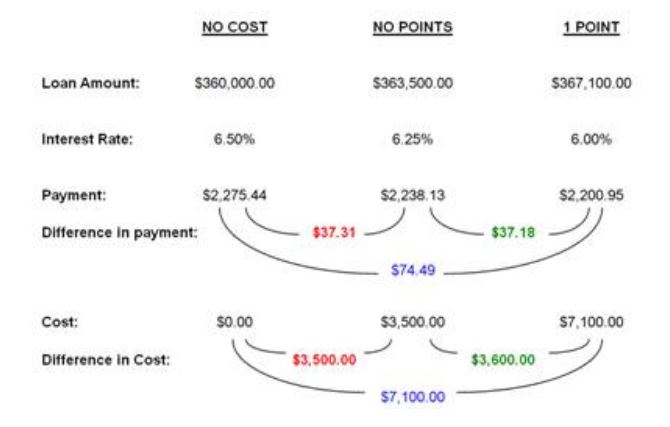

Typically yes. But the true answer to that question depends on your long-term outlook, goals and how interest rates compare at the time you are shopping. Let’s compare a no-cost loan to a loan that has no points and a loan that has 1 point. The loans we will be comparing are all the same 30-year fixed-rate loans with different interest rates and fees. All of these loans will have recurring fees that you will have to pay but they are almost the same on each and for that reason we will leave them out of the examples below. We only want to compare what we can change – rates and fees. These fees will make no difference in the outcome of the comparison we are about to do. Recurring fees are interest, taxes and insurance.

Let’s assume you are shopping for a new loan on your home. You owe $360,000.00 and you are currently paying a higher interest rate than is available today or you have an Adjustable Rate Mortgage (ARM) and want a 30-year fixed rate loan. There is no magic to a no-cost loan; the less closing costs you pay the higher the interest rate you will receive. Another way of looking at that is the more closing costs you pay the lower the interest rate you will receive. The first thing we have to understand is that the non-recurring closing costs are the same (within a few dollars) on all three loans. The non-recurring fees are based on the loan amount of $360,000.00. The total non-recurring fees for a $360,000.00 refinance are estimated to be $3,500.00.

So here is what we know:

On the no-cost loan there are zero non-recurring fees.

On the loan with no points you will still have to pay the $3,500 in non-recurring fees.

On the loan with 1 point you will have to pay $3,600 in points plus the non-recurring fees of $3,500. This loan will cost you $7,100.

In order to compare these loans we have to adjust the loan amounts to include the fees associated with each one. This will help us to discover the best deal, comparing apples and apples. You might ask yourself why we are increasing loan amount to cover fees. You may want to pay closing costs with the money you have saved. The answer is that we want all of the loans to be equal. If you are willing to write a check to pay for $7,100.00 worth of fees on the loan with one point we would argue that on the no cost loan you could write the same check but it would be applied to the principle balance of your loan. This way you would only need to borrow $360,000.00 minus your check for $7,100.00 and your new loan amount $352,900.00. We are only trying to make each loan the same by adjusting the amount of money you will have to spend at closing to the same on each loan below.

The next question is what is my breakeven point? Or simply am I willing to spend $3,500 or $7,100.00 to save about $37.00 a month? Let’s see.

$3,500.00 divided by $37.31 equals almost 94 months or 7.8 years.

Breakeven point between zero-points loan and 1-point loan.

$3,600.00 divided by $37.18 equals almost 97 months or 8 years.

Breakeven point between no-cost loan and 1-point loan

$7,100.00 divided by $74.49 equals almost 95 months or 7.9 years.

Now you have to decide a couple of things. One, will I be in this house for more than eight years. If the answer to that is yes, then you may want to ask yourself if you think that interest rates will not be lower than they are today for the next eight years. If you feel that you will be in the house that long and that interest rates will never be lower than they are today, then you should pay the point and get the lower interest rate. If you think you will not be in the house for eight years than the no-cost loan is the right decision. If you think that there is a good chance that over the next eight years interest rates will be lower, than the no-cost loan is the right decision. The end result of the example above is that you will not start saving the $37.00 a month until eight years from now. If you only remember one thing, remember this: you will never recoup costs and fees but you can always recoup your equity. Lenders want you to pay fees. Some brokers and loan agents act like if you’re not writing a check in escrow you are not spending your money. Your equity is your savings account and it is your money. On the no-cost loan we do not have to increase your loan amount to cover fees. Your equity stays the same.

Also, never take a loan with a prepayment penalty. If interest rates fall or you have to sell your home you may not be able to get out of the loan you have or you may have to pay a huge fee to get out of it.

The best part of a no-cost loan is that there are no regrets because there are no fees. If interest rates fall you can simply refinance to the lower rate. If interest rates increase you’ve gotten a very good deal for at least the next eight years. Chances are very good that in eight years, in the example above, interest rates will fall and you will be able to better the interest rate you have with no loss of equity (your savings). If you can lower your current interest rate at no cost you should do it. The no-cost loan decision is a no brainer. If you want to pay points and fees you want to try to time the market and only pay those fees when interest rates are at their lowest point. Good luck, this is almost impossible. Paying fees can bring a lot of regret. If rates fall you may have spent a great deal of money on fees for nothing.

How Does An Adjustable Rate Mortgage (ARM) Work?

Sometimes things can be made to be as complicated as possible and because of that nobody but the most sophisticated financial minds will understand it. The purpose of this explanation is to give the average person a better understanding of how things work. I will try to explain this in the simplest of terms. I will also try to stay away from technical terms as much as possible. All adjustable rate loans work the same way. They all have the following important elements:

·Starting Interest Rate. Sometimes called the start rate, initial rate or teaser rate.

·Adjustment Cap. Maximum rate increase or decrease that the lender adjusts your interest rate at any given time.

·Life Cap. The maximum interest rate that can ever be charged on the loan.

·Margin. I like to think of this as a profit margin. As you will see this is the most important number in the contract. This is the amount of money a lender will charge you over and above the cost of the money the lender borrowed. In other words, a lender goes out and borrows money at a certain interest rate and they turn around and lend to you after they increase the rate by the amount of profit they wish to make. The margin is a fixed number that will never change during the life of the loan.

·Index Rate: This is a published rate that the lender agrees to use to establish the interest rate you will be charged. In simple terms, this is the interest rate that lenders pay to borrow money that they will eventually loan to you. Some of the more popular index’s are the six-month or the one-year T-Bill, one-month, six-month or one-year Libor, 11th District Cost of Funds, and the prime rate. There are many. This published rate can and will change often.

·Real Interest Rate. This is the interest rate that is determined by adding the index rate plus the margin. The cost of the money to the lender plus their profit margin equals the interest rate that you will be charged.

·Minimum Interest Rate: Sometimes called the floor rate. This is the lowest interest rate you can ever pay on this loan.

All of these terms are written in to the promissory note, which is a contract between the lender and the borrower (you). Remember that all things in the contract must be honored at all times.

The only difference between ARM loans is when the interest rate adjusts. Some adjust every month, some adjust once every six months and some adjust only once a year. ARM loans that adjust every six months usually have an adjustment cap of 1.000%. Loans that adjust every twelve months typically have an adjustment cap of 2.000%. In either case they can adjust 2.000% per year. Either 1% twice a year or 2% once a year. Beware: Most ARM loans that adjust monthly have no maximum or minimum adjustment cap. They can go from the initial interest rate to the real interest rate in one month and they do exactly that.

Let’s use an example to illustrate how an ARM works. This loan will adjust once a year. All of these types of ARM loans are fully amortized loan, which mean that a portion of each payment that you make goes to the balance of your loan and a portion of the payment covers the interest on the loan. They get paid off just like a 30-year fixed rate mortgage. The only difference is that the payment changes with an adjustable- rate mortgage and the payment on a fixed rate loan stays the same.

We will borrow $500,000 based on the one-year Treasury bill index.

This loan has the following features:

·Starting Interest Rate: 500%

·Adjustment Cap: 2% annually

·Life Cap: 000% above starting rate. 4.500% plus 6.000% = 10.500%

·Margin: 750%

·One year T-bill index as published in your local newspaper. 120%

·Real interest rate: index rate plus margin. 120% plus 2.750% = 6.870%. This rate will always be rounded up to the nearest eighth of a percent (* to see eighths table look below). In this case they would round the 6.870% to the next eighth of a percent to an even 7.000%.

·Minimum Interest Rate: 000%

On a $500,000 loan amount at a starting interest rate of 4.500% your fully amortized payment will be $2,533.43.

ADJUSTMENT PERIOD: The loan can adjust every 12 months.

When your first twelve months elapse the lender will look to adjust the interest rate on your loan based on the terms of your contract. Remember that all parts of the contract must be honored. This is a good thing. So at the adjustment period the lender will run the following calculation to determine your new interest rate. We have to make one assumption at this point on the index value. Let’s say the index rose from the initial 4.120% to 4.375%.

First the lender will look at your current rate of 4.500% and, based on the contract, they can only adjust your interest rate up or down by 2.000%. Remember the adjustment cap in the contract is 2.000% per adjustment, or every twelve months.

Current rate 4.500% plus adjustment cap 2.000% = 6.500%

Next the lender will look at the real interest rate on the loan.

Current index rate (assumed to be) 4.375% plus the margin 2.750% = 7.125%

Finally the lender will look to see the life cap (the maximum interest rate that can be charged). The lender will take the starting interest rate of 4.500% plus the life cap of 6.000% = 10.500%

Based on the three calculations that the lender preformed above the lender will have to decide what interest rate to give you when it is time for your loan to adjust. This is the important part. Remember that you and the lender have a contract. To comply with that contract the lender must adjust your rate to the smallest of the three calculations above. The new rate on your loan would be 6.500%.

If the lender tried to adjust your rate to 7.125% this would violate the maximum adjustment term of the contract of 2.000%. If the lender tried to adjust you to the maximum life cap of the loan this would violate the maximum adjustment cap of 2.000% and the real interest rate cap of 7.125%. As you can see the borrower always get the lowest number of the three.

In the example above your new payment would be calculated using the remaining balance of your loan and the new interest rate over the remaining 29 years. Your remaining balance at the end of 12 months would be $491,933.82. The new interest rate as calculated above is 6.500%. Your new fully amortized payment would be $3,144.50.

Your new payment would increase by $611.07 per month over your old payment.

(New payment $3,144.50 minus old payment $2,533.43 equals $611.07.)

Your second adjustment would occur after 24 months. At this point we will assume that the index did not move and remains at 4.375%. Here is the second set of calculations:

First the lender will look at your current rate of 6.500% and, based on the contract, the lender can only adjust your interest rate up or down by 2.000%. Remember the adjustment cap in the contract is 2.000% per adjustment or every twelve months.

Current rate 6.500% plus adjustment cap 2.000% = 8.500%

Next the lender will look at the real interest rate on the loan.

Current index rate (assumed to be) 4.375% plus the margin 2.750% = 7.125%

Finally the lender will look to see the life cap (the maximum interest rate the lender can charge). The lender will take the starting interest rate 4.500% plus the life cap of 6.000% = 10.500%

The new rate on your loan would be 7.125%

If the lender tried to adjust your rate to 8.500% this would violate the real interest rate calculation. If the lender tried to adjust to the maximum life cap of the loan this would violate the maximum adjustment cap of 2.000% and the real interest rate cap of 7.125%. As you can see the borrower always get the lowest number of the three.

In the example above your new payment would be calculated using the remaining balance of your loan and the new interest rate over the remaining 28 years. Your remaining balance at the end of 24 months would be $486,000.83. The new interest rate as calculated above is 7.125%. Your new fully amortized payment would be $3,144.50.

Every 12 months the lender would run the same calculation and determine your new interest rate. Once you adjust to the real interest rate (index rate plus margin) your rate should stay fairly stable and only move if the index value moves. If the index goes up there is a good chance that your interest rate will too. If the index goes down there is a good chance that your interest rate will go down. If the index stays the same so will your interest rate.

What To Watch Out For With An Adjustable Rate Mortgage (ARM)?

Make sure that the ARM loan you choose has as low a margin as possible. The margin is the most important number in an ARM loan. It determines the real interest rate you will pay over time. Margins are negotiable depending on the fees a lender will charge or based on the start rate you choose. Typically the higher the starting interest rate the lower the margin. The higher fees (points) paid the lower the margin. You have to decide which structure works best for your goals. Not all mortgage brokers will discuss these options with you. Be careful who you deal with.

ARM loans can cause your payment to go up and typically do. Remember not to take an ARM loan with a prepayment penalty. Prepayment penalties are expensive and usually last for three years. The prepayment penalty for a $500,000.00 loan with a current interest rate of 7.125% is $17,812.50

When Should I Take An Adjustable Rate Mortgage (ARM)?

Before deciding to take an ARM loan make sure you are capable of making the real payment based on the real interest rate. Or make sure that you are taking this loan for the short term with the anticipation of refinancing or selling the home. A prepayment penalty can hinder your ability to refinance or sell the house. ARM loans are not bad loans. In fact, some argue that ARM loans have out preformed fixed rate loans. Some say the opposite. You can use an ARM loan to your advantage if you just simply understand how they work.

* Eighths Table: 0.000%, 0.125%, 0.25%, 0.375%, 0.500%, 0.625%, 0.750%, 0.875%, 1.000%

When Should I Take An Adjustable Rate Mortgage With Payment Options (Option ARM)?

Before deciding to take an ARM loan you should make sure you are capable of making the real payment based on the real interest rate. Or make sure that you are taking this loan for the short term with the anticipation of refinancing or selling the home. A prepayment penalty can hinder your ability to refinance or sell the house. This type of loan is not for everyone. It could be a valuable loan to someone who wants to flip a house. It keeps the payments at a minimum until the home is repaired and sold. It can also be a good loan for someone that is either self-employed or on a commission paying job. The low payment option can be made in slow months and overpayments can be made in good months. It can also be a good loan to use when you want to free up cash to pay down other higher interest rate loan. When the other debt is eliminated you can start making higher payments on this loan. ARM loans are not bad loans. Some would argue that ARM loans have out preformed fixed rate loans. Some say the opposite. You can use an ARM loan to your advantage if you just simply understand how they work.

How Does a Three-, Five-, Seven- or 10-Year Fixed-Rate Loan Work?

These loans are very simple. They are adjustable-rate loans that are fixed for, depending on which one you pick, three, five, seven or 10 years and then convert to a one-year adjustable. See the section “How Adjustable-Rate Mortgages Work” for further explanation on how these loans adjust after the initial fixed-rate period expires. Typically these loans have a slightly lower rate than 30-year fixed-rate loans. The lender is willing to give you a little better interest rate because the term of the loan is shorter. Less time equals less risk to the lender, which in turn means a lower interest rate to you. These loans are very attractive. I believe (but don’t quote me on this) that the average life of a loan is somewhere between five and seven years. If you don’t plan on keeping the home or the loan for very long these loans can save you a lot of money. The downside of these loans is when they start to adjust.

Let’s say you chose the five-year fixed term. The loan would remain fixed for the five years and then convert to an adjustable-rate mortgage that can adjust a maximum of 2% every twelve months. The big kink in the loan is that the first adjustment the loan makes at the end of the fixed period is a maximum of 5%. If the loan you picked had an interest rate of 5.50% for five years, the loan at the end of this term, could jump as high as 10.50% (5.5 + 5 =10.5). Of course the lender would look to see if the index plus margin allowed the loan interest rate to go that high. If the index were, at this future date, let’s say 5.25% and the margin on your loan was 2.75% the highest the lender could increase your interest rate would be 8.0% (index + margin = real interest rate / 5.25 + 2.75 = 8.0). After the first adjustment the loan works exactly like an adjustable-rate mortgage (ARM).

These short-term fixed-rates are great loans if you don’t plan on keeping the home or the loan for a long period of time. Can you still use this loan if you want to keep the home for a long time? Yes, this type of loan can save you money in the short run and can even help you build equity at a faster rate if you know what to do. As you know when you make a fully amortized payment, in the first few years of a loan, there is very little principle applied to the balance of the loan. If we took a 30-year mortgage for $375,000.00 at an interest rate of 6.25% our fully amortized payment would be $2,308.94 a month. At the end of five years we would still owe $350,014.64. If we took a five-year fixed rate at a lower interest rate of 5.75% our payment would be $2,188.40. At the end of five years on this loan we would still owe $347,858.05. Our payment was lower because our interest rate was lower and we owe less on the loan after five years ($350,014.64 minus $347,858.05 equals $2,156.59). Not much of a difference but every little bit helps. To help magnify these results you can take the lower interest rate on the five-year mortgage but make the higher payment you would have had to make on the 30-year mortgage. If my monthly payment on the five-year mortgage is $2,188.40 but, each month I make the higher payment I would have had on the 30-year loan of $2,308.94 I will accelerate the payoff of the loan. My payment is $2,188.40 but I pay $2,308.94. This means that the overpayment ($2,308.94 minus $2,188.40 equals $120.54) is applied directly to the balance of the loan each month for five years. The balance of the loan at the end of five years would be $339,501.78. This would substantially lower my loan balance in five years.

What Are Interest Only Mortgages?

Interest only mortgages are loans that have no principle reduction. The payments you make are only enough to cover the interest owed on the loan. There is no reduction in the loan balance. If you borrow $375,000.00 on a five-year fixed interest-rate mortgage and make only the interest payments, at the end of the five-year term of the loan you will still owe the $375,000.00 that you borrowed. How is an interest only loan payment calculated? You simply take the amount borrowed and multiply it by the interest rate you obtain and divide that number by 12 months. Example: $375,000.00 (loan borrowed) times 5.75% (interest rate) divided by 12 (months) equals $1,796.88 (interest only payment). Any and all loans (three-, five-, seven-, 10-, 15-, 30-year and adjustable-rate mortgages) today are constructed so that you can make an interest only payment. You can choose at the beginning of a loan, and only at the beginning of a loan, to have an interest only payment option made available to you. But, you must set this up at the beginning of the loan. You cannot add this feature at a later date. If you want this feature and do not have it currently you will have to refinance into a new loan with the interest only feature.

When Should I Consider An Interest-Only Loan?

The purpose of an interest-only loan is to lower your monthly payment to help qualify you for a bigger mortgage or a more expensive home. It can also be used to free up cash so that you can make larger payments on other forms of high-interest debt, such as credit cards or a home equity loan. This loan can help you get out of debt as long as you use your money wisely and direct it either into paying off other forms of debt or into savings. At anytime your savings can be used to reduce the balance of your loan by simply making a lump sum payment from your savings toward the balance of your mortgage. Or you can let your money grow by continuing to save (see “Rule Of 72”). Remember not to accept a prepayment penalty on any loan you obtain. A prepayment penalty can hinder your ability to sell or refinance your home when you need to. Lenders like these interest-only loans because they make more money. On a fully amortized loan the lender earns less interest each month because the balance of the loan is reduced each month. They can only charge you interest each month based on the balance of the loan. Since interest-only loans have no principle (loan) reduction the lender earns the same amount on the loan every month. Let’s take a look at a fully amortized loan vs. an interest-only loan. You borrow $400,000.00 at an interest rate of 5.75% on both loans. On the interest-only loan you will pay the lender $23,000.00 in interest each year you have the loan. On the same loan with a fully amortized payment you will pay the lender $22,865.80 in interest in the first year and this amount declines each year that you have the loan. If you were a lender which loan would you rather make? I would think the loan that yields the highest profits. This doesn’t mean that interest-only loans are bad. It means use them wisely to your own advantage not the lenders.

What Is The Difference Between A Full-Documentation And A No-Documentation Loan?

Almost all loan programs will give you the option of supplying your personal financial documents (pay stubs, bank statements, etc.) or not. The difference between supplying your financial documents and not supplying your information is the interest rate you will receive or, the fee you will pay. A no-documentation loan typically has a higher interest or a higher fee associated with it. There are exceptions to this. A purchase with a very large down payment may offer the same interest rate and fee whether you supply your financial documentation or not.

As a mortgage broker who wants repeat business, I will always want to see your financial information. I may not use it but I would like to see it. Knowing your true financial position will help me help you in planning for other purchases or refinances. Knowing more about you will help me match you with the best mortgage for your situation. I never want to put someone in a home or investment property that they cannot afford or that does not make sense.

How Does A Home Equity Line Of Credit (HELOC) Work?

A home equity line of credit works very much like a credit card and all of them work the same way. The only differences are that a home equity line of credit is attached (recorded) to the equity in your home; it has a much higher credit limit, and the interest you pay is typically tax deductible. You will need to check with your certified public accountant (CPA) on the tax deductible aspects of a home equity line of credit because they can vary from person to person and home to home. All home equity lines of credit are adjustable rate mortgages. They are usually tied to the prime lending rate which means when the prime lending rate moves so does the interest rate on your line of credit. The interest rate the lender will charge you can depend on your credit rating, the equity in your home and the size of the loan you are applying for. The interest rates don’t change by much and for the most part the interest rate you receive will be prime rate or prime plus or minus 0.50% to 1.5%. Home equity lines of credit are usually free (no closing costs) to obtain but do have an annual maintenance fee of about $50.

Home equity lines of credit vary slightly in term. They usually have a 15- or 30-year term with a draw period of either five or ten years respectively. The draw period is the timeframe in which you can use the line of credit like a credit card. During the draw period the lender will only charge you interest on the balance that you owe on the line of credit. You can always over pay to reduce the balance. At the end of the draw period the lender will take the balance you owe on the line and amortize the balance over the remaining term of the loan.

Let’s look at how this works. For this example let’s assume that the prime lending rate is 7.75%. The lender has approved your loan and given you a line of credit of $100,000 for a 30-year term. With a 30-year tem the draw period would be 10 years. If you took a 15-year term the draw period would be five years. The interest rate you receive on this loan is prime rate, or 7.75%. When you open the line of credit you took no draw on the line, which means you owe nothing. You have not used any of the money made available to you so you have access anytime you want over the 10-year draw period to the whole $100,000 that was made available to you. Your payment at this time would be zero.

Let’s say a month goes buy and you need $8,000 to remodel your bathroom. The lender will supply you with a checking account that is attached to the line of credit. At this point you simply write a check from this account for the $8,000. Now your balance on the line of credit is $8,000, and you have a beautiful new bathroom. The lender will start to charge you interest on that money. Your minimum payment at this time would be $8,000 times 7.75% divided by 12 (months) equals $51.67 per month. This is an interest only payment. If you make this payment the balance of $8,000 would remain the same. Now let’s say you got a large, unexpected bonus at work and decided to pay off the $8,000. The loan balance would be paid off but the line of credit is still available to you for the remainder of the 10-year draw period. The only way to close this loan is to request that it be closed. The line would also be closed if you sold the home. You can not take the line of credit with you. You would have to apply for a new line on your new home.

During the 10-year draw period you’ve used the account, paid it off and used it again. Now let’s say that at the end of the 10-year draw period you still owe $60,000 on the line of credit. Understand that the draw period is now over and you can no longer write checks on the account even though you have not used the whole line of credit. The lender would at this time take the $60,000 you owe and calculate a fully amortized payment that would pay off the loan over the remaining 20 years. Your payment would be, assuming that the prime lending rate was the same, $492.57 a month. Realize that the loan is still adjustable and the payment will change if the prime lending rate changes. Some home equity lines of credit have three-year prepayment penalties. This does not mean that you will be assessed a penalty for paying off the balance on the line of credit. They will only charge you the prepayment penalty if you decide to close the line of credit all together within the first three years. The prepayment penalty is usually small – typically only around $400. Not much at all.

Why Should Everyone Have a Home Equity Line Of Credit (HELOC)?

There are lots of reasons to have a home equity line of credit and only one reason not to. The most important reason to have one is that things happen, and it is good to be prepared for the unexpected. Over the many years I have spent helping people obtain home loans nothing pains me more then when one of my clients calls me for a loan because they have been laid off from work or gotten sick and have had to leave work. Lenders are a lot like insurance companies. They are there for you when you don’t need them. And when you do they are not there. You cannot get a loan or home equity line of credit when you are out of work. So get one when you are still employed and don’t need it. It only costs $50 a year to keep one open and you don’t have to use it. But, if you have a line of credit you will have the funds you need when you need them.

Another good reason to have a home equity line of credit is just in case you want to buy another home. Let’s say you see the home of your dreams or a great deal that you can make some money on and you know the home will not be on the market very long. You want to buy it but need to sell your home first in order to do so. The seller may not want to take your offer over someone else that doesn’t have to sell a home in order to buy. You lose the home. An equity line of credit can serve as your down payment on the home. When you sell your home the line of credit is paid off and closed. Sellers are much faster to accept an offer without contingencies like the sale of your existing home. They don’t want to gamble on you ability to sell your home when another buyer doesn’t have to.

Construction projects are also a very good reason to have a home equity line of credit. Let’s say you are going to put an addition on your home. The first thing you need to know is that once construction starts on your home no lender will loan you money. They are afraid of mechanics liens. Mechanics liens come, in case of foreclosure, before a mortgage that was done after construction was started. Construction projects always go over budget. This is the law of construction. When you apply for a home equity line of credit get the biggest line of credit you can. It can come in very handy–even if you don’t use all of it. Let’s say you need a loan of $200,000 to complete your project. The project will take eight months. In the first month you need only $50,000 and each month after that you will need smaller amounts of say $25,000 here and $10,000 there until the project is completed. Why take out a fixed rate mortgage for the whole $200,000 and pay interest on all of the money every month when you are not using the money? On a home equity line of credit you only have to pay interest on the money you have used. If you go over budget, as you will, the equity line can have a higher balance than you need. In this case your line of credit is for $300,000 a nice safety net. At the end of the project you can look into refinancing into a nice fixed rate mortgage.

The only reason not to get a home equity line of credit is if you cannot control you spending. Do not get a home equity line of credit if you know you will spend the money in a non-productive manner. Know what kind of person you are. A home equity line of credit should only be used for an emergency or a specific project like a new roof, to get through a layoff, an unexpected illness, construction or a new home purchase.

Is a Bi-Weekly Mortgage a Good Idea?

Yes and No is the best way to answer this question. A bi-weekly mortgage is a mortgage that has payments every two weeks instead of one a month. All lenders and all types of loans, fixed or adjustable, allow for by-weekly payments. This type of loan will cut years off your mortgage and that’s great if you want to payoff your loan. Let’s face it; we would all love to payoff our mortgage. What most people assume is that the mortgage payment is made twice a month instead of one a month. This is not true. The payments are every two weeks. Let me illustrate this. There are 52 weeks in a year. Divide the weeks in the year by two (payments are every two weeks) and you come out with 26 payments per year. If you simply took 12 months and divided it by 2 you would come out with 24 payments a year. As you can see the bi-weekly mortgage has 2 extra payments during the year (26 minus 24 equals 2 extra payments). Each payment is one-half of your full monthly payment. So these two extra payments are the same as making one extra full payment a year.

I have two problems with the bi-weekly mortgage. The first problem is that lenders will charge you a fee to set up the bi-weekly payments. Why pay the fee for something you can do on your own? Simply take your current mortgage payment and divide it by 12 months and add that amount to your monthly payment. The results are the same as with a bi-weekly mortgage, you make one extra payment a year. Example: A mortgage amount of $300,000 over 30 years with an interest rate of 6.0% would have a payment of $1,798.65 per month. Simply divide your monthly payment by 12 ($1,798.65 divided by 12 equals $149.89). Add this amount to your monthly payment, $1,798.65 plus $149.89 equals $1,948.54. Make the payment of $1,948.54 each month and you will cut the term of your loan from 30 years down to twenty-four and half years. This offers the same result as the bi-weekly payment but you didn’t have to pay a fee to achieve the same goal. Not setting up the bi-weekly payment and doing it this way allows you the freedom to not make the higher payment in tight months. With the bi-weekly payment schedule you are stuck with the new payment schedule.

The second problem with a bi-weekly mortgage is that most people get paid twice a month not every two weeks. When the lender sets you up with a bi-weekly mortgage they set you up with auto-pay. Every 14 days they withdraw the funds from your checking account. If you get paid twice a month the funds may not be there when the lender tries to withdraw the money. You can speculate on what happens next. Insufficient fund charges from your bank and your lender. Not fun!